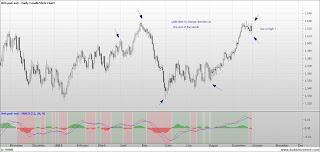

The daily chart looks like a triangle and triangles are not normally the end of the move,which suggests more downside (ED's excepted)

However the weekly chart bears watching with regards to the Gann harmonics at 72 weeks,144 points.The square of 144 was used to succesfully call the high last year

The high was 309 so 154.5 is important support

However the weekly chart bears watching with regards to the Gann harmonics at 72 weeks,144 points.The square of 144 was used to succesfully call the high last year

The high was 309 so 154.5 is important support

.png)

.png)

.wedge.png)

.png)

.png)

.png)

.png)

.png)